www.mypremiercreditcard.com – First Premier Bank Credit Card Access

Finance

First Premier Bank is a financial organization offering a range of non-traditional and traditional banking products including savings, checking accounts, loans, mortgages, credit card services, ATM Vault Cash service, trusts and many more under one roof. Its headquarter is located in Sioux Falls, South Dakota, USA. Consistency, trusts, and exclusivity of service to each of its customers has made First Premier Bank one of the prominent financial organizations to look out for in times of need. As the name suggests, the premier services are synonymous with every customer of First Premier Bank.

First Premier Credit Card – Rates and features

First Premier Credit Card has been designed to cater to the customers with a low credit score helping them to obtain all the facilities of the MasterCard. Yes, First Premier Credit Cards are FDIC recognized by the MasterCard. First Premier Bank MasterCard is an unsecured card offering wide range credit profiles compared to the other credit cards available. Here are some of the features along with the rates and APR:

- Someone with less than average credit score can easily apply.

- Quick application and response within 60 seconds.

- Avoid interest charges with 27 days grace period for the monthly statement balance.

- Free FICO score to be included quarterly on your bill statement.

- The APR is 36 %.

- Zero monthly services and an annual fee for the first year. Post that, the annual fee will be from $50 to $125 based on your credit limit.

- The monthly servicing fees are $6.25 to $10.40.

To know more about the foreign transaction fees and other rates, please visit www.mypremiercreditcard.com.

More Read: FlemingsListens Survey – WIN A $20 Discount

Applying for First Premier Credit Card

Next is to know the method of applying for the First Premier Credit Card. There are two ways through which one can apply for the card. According to the credit records and financial history, many of the applicants whose financial background seems suitable for the credit card will be sent Confirmation Number for the pre-approved offers directly by the bank via mail or email.

Truth to be spoken, one who has received pre-approved offers will have a better chance for approval. However, it is not a sure shot thing. With relevant financial activity, one who does not have a pre-approved offer can still make the application and get a chance of approval. Without much ado, jump to the application steps:

- Please log on to www.mypremiercreditcard.com.

- Scroll down and click on the Apply Online Now!

- Those who have a pre-approved offer may enter the confirmation number from the mail received and click on Apply Now.

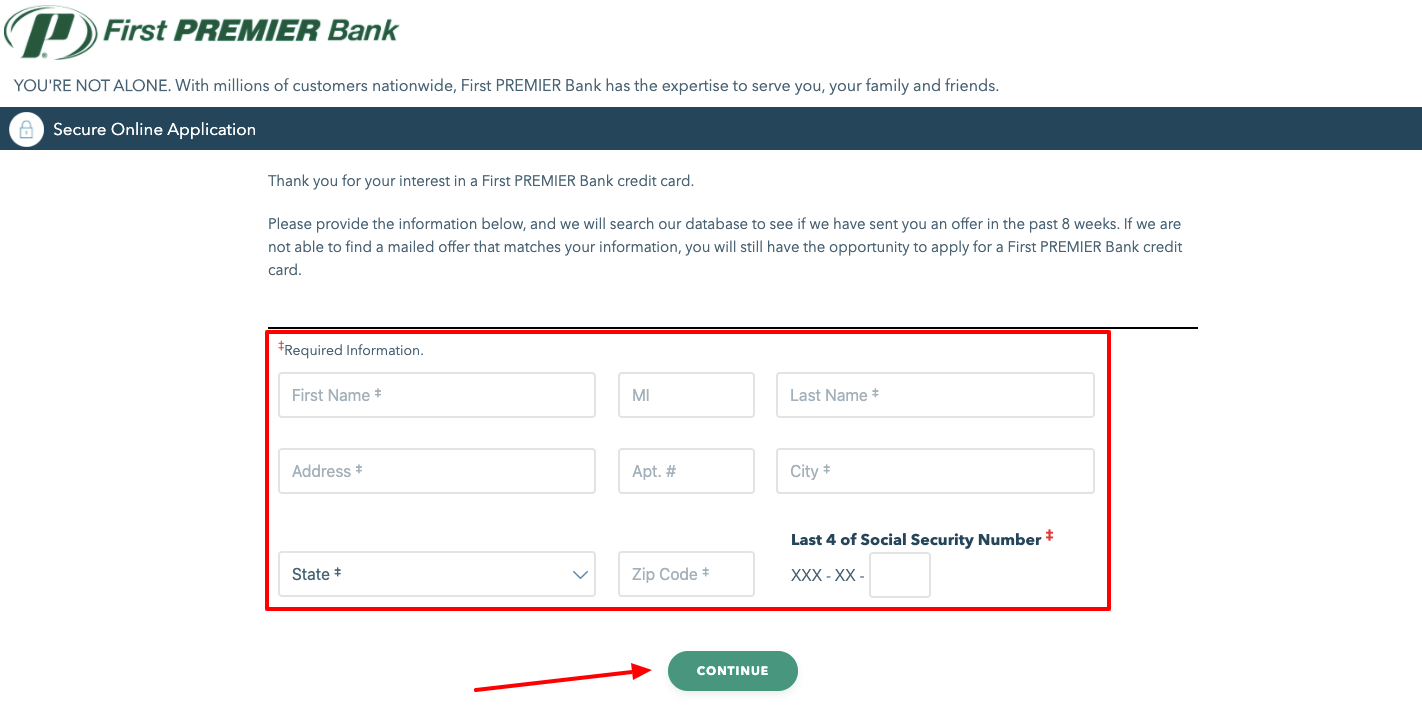

- If you have misplaced your mail offer or want to look up for any pre-approval offer in past eight weeks, then click on Lookup for your confirmation number

- Enter the following info one by one:

- First Name.

- MI.

- Last Name.

- Address.

- Apt.

- City.

- State.

- Zip Code.

- Social Security Number’s last four-digit.

- Click on Continue to check for your confirmation number.

- If you do not have a confirmation number, then please come back to the first application page and under APPLY FOR A CREDIT CARD, click on Apply Now.

- So from here, one with pre-approved offers and one without one have to follow the same procedure. One by one enter the following info and fill up the application form:

- First Name.

- Middle Initial.

- Last Name.

- Address.

- Apt Number.

- City.

- State.

- ZIP Code.

- Staying time in the current residence(years and months)

- Residence Type.

- Cell Phone or Home Phone.

- Specify your Bank Account type.

- Date of birth (mm-dd-yyyy)

- Social Security Number.

- Email Address.

- Check on the Continue to go on with the application procedure. Go through the offers available; select the best one for you. And it will just take 60 seconds to let you know if you are approved or not. If approved, you will be redirected regarding the further process for the completion of the application.

Online Account Setup

After the First Premier Credit Card activation, you can activate the online credit card banking account. It will present to you the management and transaction of your credit card right at your fingertips. Here are the reasons why you should register your credit card for an online account:

- Print, view and download the account statement.

- Added security for online transactions and internet banking.

- Meticulous organization of the online accounts.

- Save the environment by going paperless.

- Integrated First Premier mobile banking application to access your credit card within your fingertips. Available in both Android and iOS.

The reasons are enough. Now check out the methods to quickly set up an online account.

Also Read: CPKSurvey – WIN Free High Quality Food

First Premier Credit Card Registration

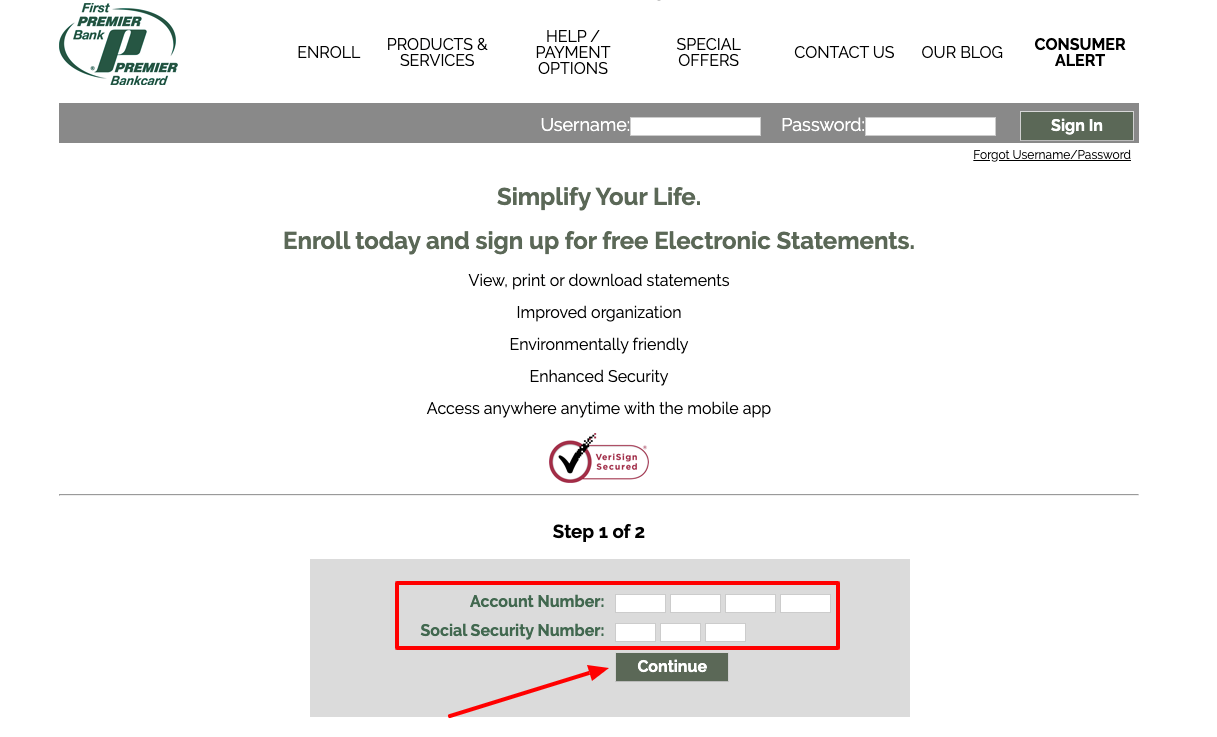

- Log on to www.mypremiercreditcard.com.

- Click on the Enroll

- Type your credit card account number written on the credit card statement.

- Type your Social Security Number.

- Click on Continue.

- Next, create a username for your online account. Username must be 8 to 12 characters. It must not contain any spaces, symbols or special characters.

- Device a password. The password must be a minimum of 8 and a maximum of 12 It must be a combination of upper, lower, special characters and numbers.

- Check the Terms and Conditions given and accept them.

- Next, place the Request for Passcode. The passcode is unique for your account gives an added security to the MasterCard credit cards.

- Choose the medium via which you wish to receive your passcode. You can select email, text or phone call to receive your passcode.

- After obtaining the passcode, please enter the code on the designated field.

- Re-enter the password you have created to confirm.

- Select if you are accessing from a private or public computer. (It is recommended to commence the registration process via a private device).

- Click on Continue to conclude online account set up.

Access

Post-registration, you can log in to your online account anytime and anywhere.

- Open your browser and visit www.mypremiercreditcard.com.

- Enter the username.

- Enter the Password.

- Select Sign In.

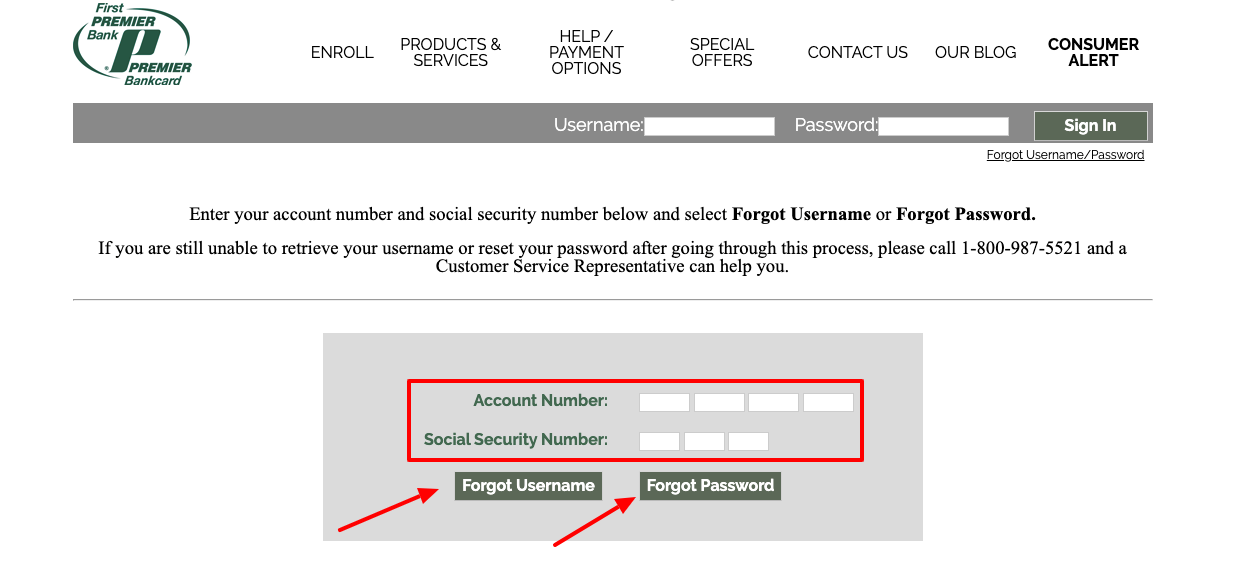

Retrieve Credentials

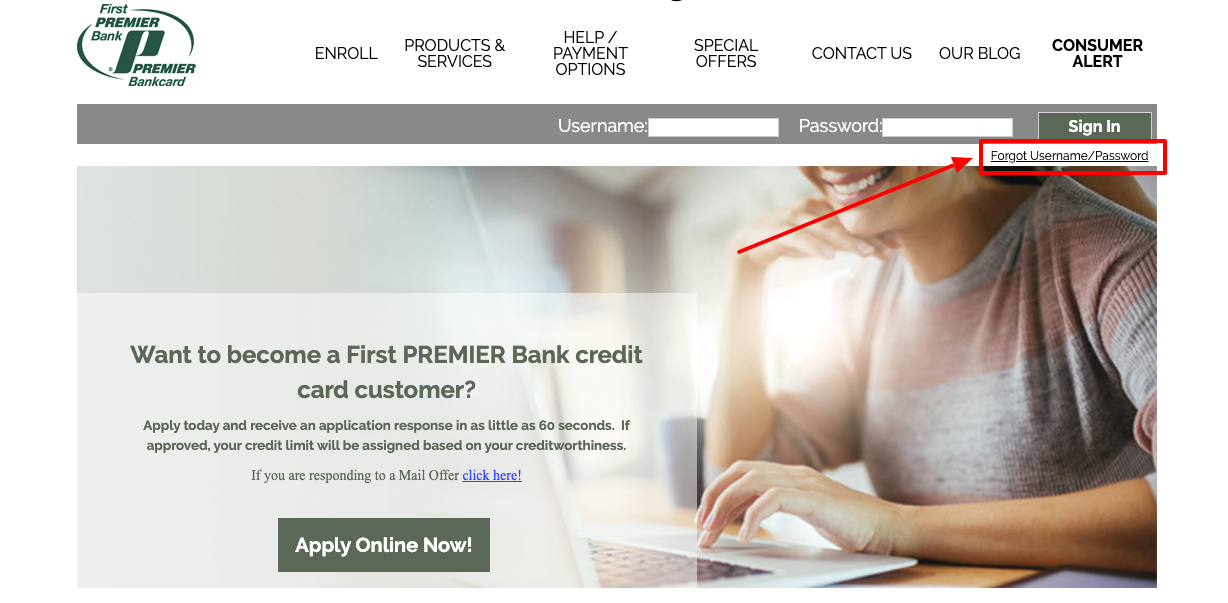

For instances when you forget either of your credentials, username or password, please go through this step to troubleshoot:

- Open your browser and visit www.mypremiercreditcard.com.

- Click on Forgot Username/Password.

- Please keep on entering the following info:

- Account Number.

- Social Security Number.

- Click on Forgot Username or Forgot Password according to the concern.

- Follow the prompt to recover credentials.

If you are still unable to recover your username or password after following these steps, feel free to call 1-800-987-5521 to get specialized assistance from the Customer Service Representative.

Read More: www.kwikrewards.com – Kwik Rewards Login & Sign Up

Help Desk

Phone

Calls can be commenced at the following numbers:

1-800-987-5521

1-605-357-3440

Fax

Fax at 1-605-357-3438.

Write to:

First PREMIER Bank

PO Box 5524

Sioux Falls, SD 57117-5524

Time:

Monday-Friday, 7:00 a.m.-9:00 p.m.

Saturday, 8:00 a.m.-4:30 p.m. CT.

References: